Coles Store's Strategic Competence and the Desired Future

Student’s Name

Student’s Number

Institutional Affiliation

Master of Business Administration

Lecturer

Date

Executive Summary

This report has investigated Coles Stores’ competitiveness and strategies that the company can adopt to enhance and sustain competitiveness. The report has analyzed the company’s competitiveness (position) using the Porter’s 5 Forces model. The result shows that the firm’s competitiveness is threatened by the competitive nature of the industry. The industry has few players, namely, Woolworths, Coles, ALDI, IGA, and other smaller players.

Woolworths and Coles are the influential players in the industry as they have a combined market share of over 75%. Price wars and the unpredictability of the supermarket business require the company to be embracing a creative and aggressive marketing strategy. Some of the measures that the corporation can use are by adopting business plans that would conform to the Mintzberg’s 5Ps model of strategy. Alternative strategies may include measures like low-cost business operations and the best corporate practices, among other schemes. Coles can come up with unique services and products that will make it difficult for other service innovators to thrive. Some of the measures may include widening its online shopping business and offering discounts to loyal customers

Table of Contents

1.0 Table of Contents ........................................................... 4

2.0 Porters’ Forces Analysis of Coles Store ................................................................ 4

3.0 Recommendation on Strategic and Business-Level Initiatives that based on Mintzberg’s 5Ps Model of Strategy That Coles Can Use to better its Future Competitiveness .............................................................................................................................................................................................. 5

4.0 Using Porter’s Five Forces Model to Boost the Company’s Business-Level and Corporate Competitiveness ........................................ 5

5.0 Conclusion and Overall Recommendations .............................................................................................................................................. 7

6.0 References ................................................................................................................................................................................................. 8

7.0 Bibliography .............................................................................................................................................................................................. 8

8.0 Appendix ................................................................................................................................................................................................. 10

1.0 Introduction

Coles Store is one of the leading chain stores or supermarkets in Australia. The company is a subsidiary of the Cole Group. Coles Stores is officially referred to as Coles Supermarkets Australia Pty Ltd. The company was established in 1914 and has its headquarters in Hawthorn East, (Melbourne) Australia. The company specializes in the provision of consumer services, supermarket and retail services. The company is headed by John Durkan, who is its managing director. The store has offers services in 776 locations, but this number also includes a small number of BI-LO Supermarkets. The company’s annual revenue is more than AU$33 billion (for its food and liquor services alone) (Wesfarmers, 2011). The company’s total assets amount to Au$22.1 billion while its number of employees totals more than 100,000. This report explores the company’s strategic position

2.0 Porters’ Forces Analysis of Coles Store

Michael Porter generated a five forces analysis tool that is used to analyze the competitiveness of any business. The five forces include the supplier power which involves the degree of which the suppliers have more or less bargaining power in their relationship to the company (Rajasekar & Al Raee, 2013). The second element is the buyers’ in which the tool assesses whether the buyer has more bargaining power about the company’s bargaining power. The model also evaluates the suppliers’ bargaining power or influence by comparing it to the current bargaining power held by the business. The other factor is the threat of new entrances, which assess the likelihood of new firms or companies joining the industry. Porter’s tool also investigates the threat of substitution, which explores the question of whether a company faces the threat of substitutes (products or services) that can degrade its competitiveness. The last aspect of Porter’s model is the degree of rivalry in the sector that a business operates in. Below is a detailed competitive analysis of Coles Supermarkets using the Porter’s Five Forces model.

2.1 The Supplier Power

The supermarket giant has grown exponentially over the years to acquire stronger bargaining power over its suppliers. The first Coles store was opened in 1959 in North Balwyn, Melbourne and by the beginning of 1962, the supermarket owners rebranded in the “New World” Supermarket (Langmore, 2007, p. 232). Then in 1971, New World Supermarkets emulated K-Mart’s business approach by introducing a discount policy in all its supermarkets (Langmore, 2007, p. 232). The new synergy enabled the corporation to acquire more stores across Australia. At the moment, the company has 776 stores across the country and a market share of 37.5% (King, 2016).

What Makes Coles Superior to Woolworths

In the last 3 years, the company used its market dominance to forge its own interests at the expense of the suppliers. Historically, many suppliers have relied on the company’s stores or branches to buy their products. Its market leadership position renders the suppliers of grocery and other products powerless because they do not want to lose their core client. In the recent years, the company has embarked on a price war with Woolworths as a way to enhance its own growth (Keating, 2015). The price wars often affect the suppliers bargaining power because the supermarket chains often copy each other’s strategic approaches thereby lowering the cost of groceries and other products (Burch, Lawrence & Hattersley, 2013; Sotgiu & Gielens, 2015). Coles’ price war with Woolworth has enhanced its power to dictate commodity prices and other expensive quality requirements at the expense of the suppliers (Keith, 2012). Thus, the company enjoys superior bargaining power compared to the one held by its suppliers. Coles’ success over Woolworths is based on the fact that Coles’ outlets perform more intimidation and blackmail of their suppliers compared to Woolworths. As a consequence, Coles can sell its products relatively cheaper than Woolworths.

2.2 The Buyer Power

Coles Supermarkets have designed business models that enhance buyer power. The waterbed effect appears to be the primary driver of the reasons why consumers enjoy more power on Coles Supermarkets’ operations. The waterbed model suggests that when the customer enjoys lower prices for the commodities or services, then someone else is paying for the cost of lower commodity prices (Inderst & Valletti, 2011). On Coles’ business model, suppliers pay the price for the low-priced groceries and other products sold at Coles Stores so that the buyers can enjoy the reduced prices.

There have been media reports where Coles Supermarkets branches have been accused of intimidating and threatening suppliers who have been unwilling to compromise on the companies’ lower price quotations (Hatch, 2016; Taylor, 2015). Coles expects its consumers to buy groceries at lower prices to sustain its market competitiveness. If the company fails to sell its products cheaply, it risks losing its market share to Woolworths among other players. In this regard, consumers/buyers appear to be enjoying considerable power because they determine the strategic approaches in the industry.

How Coles has Managed to Outshine Woolworths

Coles main threats over Woolworths lies in its competitive pricing policy, the freshness of products, and other key issues. In the last 2-3 years, Coles has been improving the quality of products and other services while Woolworths has been slaking. Recent (2016) UBS supermarket survey shows that consumers gave Coles a rating 7.1/10 compared to Woolworth’s 5.7/10 on attributes such as moral standing, pricing, freshness, range and other variables (Barneyc, 2016). The 7.1/10 rating was Coles’ highest ever.

2.3 Rivalry in the Retail Sector

The Australian supermarket industry or retail business is regarded as the most concentrated in the world. The Coles stores and Woolworths are the leading players in the industry. However, other upcoming companies such as ALDIN are growing faster by capitalizing on the negative reputation of Woolworths and Coles (Hatch, 2015). The rivalry between Woolworths and Coles store is well documented over the years. Between 1956 and 1966, Coles and Woolworths staged a yearly Rules Match, but which was discontinued because of the matches often turned bloody violent (Keating 2015). Price wars appear to be the primary strategy that Coles and other players have embraced to outmaneuver their competitors. In 2013, Coles lowered its price of Coles Full Cream milk to $1 per liter in the 620 Coles Express stores across the nation in response to Woolworths’ decision to reduce the price of Dairy Farmers and Homebrand milk products (McCarthy, 2013). The price wars are meant to undermine the rivals’ competitiveness.

The price wars will undermine the company’s competitiveness in the long-run. Price wars are often associated with the decline in profitability and threaten the sustainability of a particular market segment as it has been the case for the American brewer industry (Gokhale & Tremblay, 2012). Price wars can undermine the competitiveness of an enterprise because the company would be making less profit as time progresses. Under these circumstances, businesses are forced to reduce the price of their goods to sustain their existence. The net effect of this activity would be a reduction in the overall profit generated by the company. At the same time, smaller competitors lose their business because they cannot compete with the bigger companies. Thus, in theory, it is clear that the Coles store’s competitiveness is threatened by the current regime of a price war in the Australian retail industry.

What Strategies have Boosted Coles’ Competitiveness despite the Rivalry?

However, Coles combines both price war and other measures to outsmart Woolworths. In the last 2-3 years, Coles has been making less profit compared to Woolworth because of its lower pricing policy and improvement in customer service. Coles’ strategy is to snatch customers from Woolworths. In other words, Coles has been positioning itself as a customer-centered enterprise to eliminate Woolworths from the market in a gradual way.

2.4 The Threat of New Entrance

The retail industry is subject to the risk of new players just like other sectors of the economy whose business models can be emulated by any other entrepreneur. The Australian retail market is open to any new entrance because what one needs to open a retail business in the country is a license, capital, and a business strategy. For decades, Coles and Woolworths have been the main players in the industry. Many analysts have always perceived the two companies will dominate the landscape for decades (Future Directions International, 2014). Indeed, the two conglomerates (Coles and Woolworths) have a disproportionate influence over the market terms in the Australian supermarket business as they affect the price of commodities and other developments in the sector at large.

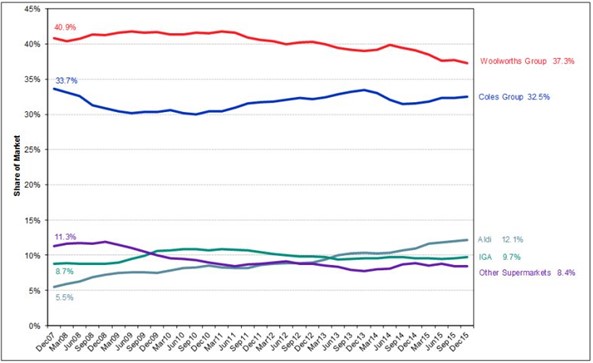

However, in the recent years, ALDI has emerged as a serious competitor for both Woolworths and Coles Store. ALDI has been taking aware Woolworths market share through its aggressive marketing and strategic initiatives. Research conducted by Roy Morgan has shown that Woolworth has lost some market share because its market size has dropped from 38.5% in March 2015 to the current 37.3% whereas Coles increased its market share to 31.8% to the current 32.5% (King, 2015). On the other hand, ALDI has grown its market share to 12.1% up from 11.6% in March 2015 while IGA had retained its share of 9.7% (King, 2015). The current state of affairs in the Australian supermarket and retail business highlight the fact that new entrances are likely to venture into the industry.

The entry of new supermarkets in the Australian service sector will undermine Coles’ competitiveness. New entrances often pose a significant threat to the existing businesses because they often unsettle the status quo (Giachetti & Dagnino, 2014). New supermarkets may come with new technologies and embrace new customer relationship tools that will undermine the competitiveness of the existing firms.

The threat of new entrances can be assessed by evaluating Coles vs. Woolworths’ profitability in the last 5 or so years. One would expect new entrances to lower the company’s profits to prove their competitive worth.

Coles and Woolworth Financial Well-Being for the Last Five Years based on Companies’

Annual Reports

| Year | Coles Supermarkets’ Annual Net Profit | Woolworths’ Net Profit |

|---|---|---|

| 2010/2011 | $1.922 billion | $2.124 billion |

| 2011/2012 | $2.126 billion | $2.18 billion |

| 2012/2013 | $2.26 billion | $2.3 billion |

| 2013/2014 | $1.76 billion | $2.45 billion |

| 2014/2015 | $2.44 billion | $1.3 billion |

Overall, both Coles and Woolworths have been enjoying stable growths in profits. However, Woolworths has started to lose ground because it witnessed a loss of $1.13 billion in 2015 and is expected to lose more ground this year as ALDI has been snatching its market share in the last few years.

What Strategies have Made Coles Better off Than Woolworths?

Cole’s growth policy is the key driver of its current competitiveness. In the recent years and months, Coles has embarked on a value-led business strategy, refurbishment of its stores and enhanced its current offer (Agpalo, 2015). The new changes minimize the potential effect of new entrances because it guarantees Coles’ market leadership. On the other hand, Woolworths has been reluctant to make changes to its profit-driven business strategy. Woolworths’s inability to cut products prices will hurt its business. As a consequence, it has lost part of its market share to ALDI.

2.5 The Threat of Substitution

The threat of substitutes will affect Coles’ competitiveness in the near, medium, and long-term future. Substitutes may be in the form of new retail services that will undermine Coles’ service provision capacity or remove it from the business. However, any industry is subject to serious competition. One cannot rule out that entrepreneurs will one day create substitutes that will undermine the company’s existing business form. Substitutes in the industry might come in the form of new modes of companies and other enticing retail services. As such, it is not possible that Alibaba.com or Amazon can eradicate it from the firm. Therefore, the threat posed by substitutes is low.

What Business-Level and Corporate Realities have Made Coles Superior to Woolworths?

Currently, the threat of substitutes is relatively small because the company has a unique business model. Coles offers the online sales and courier services that complement its business. Coles also has various petrol stations, offers financial services and other related businesses. Woolworths also has the same business model. However, Coles has a more adaptable business approach that mitigates the potential effect of any substitute service provider.

3.0 Recommendation on Strategic and Business-Level Initiatives that based on Mintzberg’s 5Ps Model of Strategy That Coles Can Use to better its Future Competitiveness

Mintzberg’s 5Ps model of strategy explores a business strategy in the context of five perspectives. The first one is the perception that a business strategy is a plan that one embraces to achieve a successful business. The second aspect is the view that a business plan is a ploy in the sense that successful companies are the ones who plot to undermine their competitors by dissuading, disrupting them, discouraging them, and, perhaps, by influencing them (de Barros Jerônimo & de Medeiros, 2013). The third aspect is the view that a business strategy is a pattern, which means business strategies are products of consistent and systematic ways of doing business. The fourth “P” represents the view that a strategy is like a position. That is, a business strategy is designed to reflect what the business person or entrepreneur intends his or her business to appear or become. The last aspect is the notion that a business strategy is a perspective or it is subject to the business or organizational culture. In other words, actions and choices made by the people in an organization are reflective of the culture of that organization. Below is a detailed analysis of how Coles Supermarkets can achieve competitiveness by utilizing Mintzberg’s approach to business strategy.

3.1 Perceive its Business Strategy as Plan

Coles should boost its competitiveness by setting up specific objectives and how it will achieve those goals. The current state of the supermarket or retail service industry requires ingenious strategies to overcome the competitive and enhance sustainability. The business plan should include objectives such as to achieve sustainable business, reduce the cost of doing things, attract and retain new customers, and achieve business growth. Then the planners should come up with appropriate mechanisms to meet their objectives. For instance, research has revealed that the company faces the threat of price wars. In this regard, the company may opt to design a business model that will withstand the price war-based competition. Perhaps, the management may decide to buy out the competitors to enjoy a monopoly. Alternatively, the company may gang up with Woolworth to operate by a cartel.

Other strategies may include proper management of talent as a means to enhance growth. Talent management is associated with the acquisition, training, and development of individuals who poses particular skills to enhance or boost the said talent (McCracken, Currie & Harrison, 2015). Talent management will make the company more competitive as it will ensure that the business has well-motivated and qualified staff compared to Woolworth’s.

3.2 Perceive its Business Strategies as a Ploys

The company should engineer its business strategy to appear as a ploy. The company may adopt strategies that will disrupt, undermine or confuse the competitors such as ALDI and Woolworths. Such strategies might include buying out Woolworth’s Australian business or producing some of its own groceries and foodstuffs instead of buying it from the farmers. The company might also offer high-end customer services that no other competitor would appreciate. Thus, the company should adopt strategies that will act as ploys to the current and future competitors.

3.3 Embracing Business Strategies that Would Operate like Patterns

Coles Stores should appreciate the fact that the competitiveness of doing business is based on regular and sustained approach. Having distinct or definite activity models will enable the company to perfect its business model and make it more efficient. The company’s current business model lacks a particular pattern because many of its business decisions are reactionary per se. For instance, the price wars influence most of the company’s strategic decisions. Instead, the company should design one business model that it will sustain and perfect for a long time.

3.4 Embrace Business Strategies that will improve its Position

Coles Supermarkets will achieve competitiveness by adopting business strategies that will improve position them as the best in the country. Appropriate positioning strategies should include both marketing design and business processes design (Wei, Zhu & Lin, 2013). Thus, the company should develop strategies that are holistic.

3.5 Embrace Business Strategies that Reflect Organizational Perspectives/Culture

Organizational culture will and has always had a significant impact on any business’s success or failure. According to Naranjo-Valencia, Jiménez-Jiménez & Sanz-Valle (2016), Organizational culture affects everything in business; from innovation to general performance. Corporate culture can be created and nurtured through a series of a deliberate effort by the management and the subordinate employees (O’Reilly, Caldwell, Chatman & Doerr, 2014). The company should adopt an organizational culture that will support its business strategy.

4.0 Using Porter’s Five Forces Model to Boost the Company’s Business-Level and Corporate Competitiveness

4.1 Sustaining a Weak Supplier Power

The company’s future success shall depend on its ability to sustain the current weaker supplier power. More Inadequate supplier power would be good for the company’s business because it will enable the supermarket chain stores to influence the price of commodities. However, the company should change the current malpractices in which the suppliers are frustrated through blackmail and intimidation which drive them to court. Perhaps, the company should form sustainable relationships with reliable suppliers who will make sure that the corporation acquires cheaper commodities.

4.2 The Company Should Undermine the Buyer Power

Australian retail customers are enjoying enormous bargaining power. In fact, it is the strong buyer power that is driving up price wars and overall competitiveness in the sector. The company can reduce the buyer power by teaming up with other players to reduce. Cartel-like business practices or oligopolistic tendencies have the capacity to undermine the consumer’s buying power. This is because cartels make it difficult for users to influence business strategies as companies collude to fix prices and address other issues that undermine their interests. Indeed, cartel-like operations are ethical, but the survival of the corporation’s business is paramount.

4.3 Coles Should Weaken Rivalry in the Sector

The company should adopt business strategies that will decrease rivalry among the key players. Price wars and expansion of express shops appears to the main strategies and counter-strategies employed by the rival supermarket operators in Australia. It is incumbent upon the company to embrace new plans that will weaken the rivalry in the sector. Examples of such initiatives might include buying out the rivals or adopting new business models.

4.4 Weaken the Threat of New Entrances

Coles should appreciate the fact that new entrances can only thrive in a sector where there is a level playing ground. ALDI has managed to take away Woolworths’ market share by adopting a strategy in which it brands its groceries as home-grown. ALDI has also used the price war tactic to attract some customers. However, Coles can undertake other measures to make the market unattractive to new entrances. For example, instead of buying goods from suppliers, the company may buy directly from the manufacturers or producers.

4.5Weaken the Threat of Substitutes

At the moment, the company does not face strong substitutes. However, the company should always be innovative in minimizing the likelihood of experiencing the threat from substitute service providers. Through research or innovation, Coles can come up with unique services and products that will make it difficult for other service innovators to thrive. Some of the measures may include widening its online shopping business and offering discounts to loyal customers.

5.0 Conclusion and Overall Recommendations

ConclusionIn conclusion, Coles Stores/Supermarkets should re-design its business strategy to reflect the dynamics in the competitive business market. The report has analyzed the company’s competitiveness (position) using the Porter’s 5 Forces model. The result shows that the firm’s competitiveness is threatened by the competitive nature of the industry. The industry has few players, namely, Woolworths, Coles, ALDI, IGA, and other smaller players. Woolworths and Coles are the influential players in the industry as they have a combined market share of over 75%.

RecommendationsStrategically, Coles should appreciate price wars and the unpredictability of the supermarket business requires the company to be embracing a creative and aggressive marketing strategy. Some of the measures that the enterprise can use are by adopting business plans that would conform to the Mintzberg’s 5Ps model of policy.

At an corporate level, the company’s business strategies might include measures like low-cost business operations and the best corporate practices, among other schemes. Indeed, best corporate practices such as training and better treatment of employees will boost Coles’ capacity to attract and retain talent (Cascio & Boudreau, 2016). Additional business-level strategies may be adopted to reflect the changing corporate desires.

6.0 References

Agpalo, J. (2015). Wesfarmers has Coles Supermarket group growth plan strategy. Food World News. Retrieved from http://www.foodworldnews.com/articles/55010/20151118/wesfarmers-coles-supermarket-group-growth-plan-strategy.htm

Barneyc. (2016). Woolworths vs Coles. ADVFN Financial News. Retrieved from http://au.advfn.com/newsletter/barneyc/39/39

Burch, D., Lawrence, G., & Hattersley, L. (2013). Watchdogs and ombudsmen: monitoring the abuse of supermarket power. Agriculture and Human Values, 30(2), 259-270.

de Barros Jerônimo, T., & de Medeiros, D. D. (2013). Enabling the strategic planning of small and medium-sized information technology through advanced results: a configurational perspective of Mintzberg 5Ps. International Journal of Business Innovation and Research, 7(6), 663-678.

Cascio, W. F. & Boudreau, J. W. (2016). The search for global competence: From international HR to talent management. Journal of World Business, 51(1), 103-114.

Future Directions International (FDI). (2014). Market power in the Australian food system. Retrieved from http://www.futuredirections.org.au/publication/market-power-in-the-australian-food-system/

Giachetti, C., & Dagnino, G. B. (2014). Detecting the relationship between competitive intensity and firm product line length: Evidence from the worldwide mobile phone industry. Strategic Management Journal, 35(9), 1398-1409.

Gokhale, J., & Tremblay, V. J. (2012). Competition and price wars in the US brewing industry. Journal of Wine Economics, 7(02), 226-240.

Hatch, P. (2016, Jan. 27). Suppliers argue Coles and Woolworths' demands unfairly help private label push. The Sydney Morning Herald. Retrieved from http://www.smh.com.au/business/retail/suppliers-argue-coles-and-woolworths-demands-unfairly-help-private-label-push-20160126-gme054.html

Inderst, R., & Valletti, T. M. (2011). Buyer power and the ‘waterbed effect’. The Journal of Industrial Economics, 59(1), 1-20.

Keating, E. (2015, Sep. 24). Supermarket monsters: Seven insights into how Coles and Woolworths came to dominate Australian groceries. Smart Company. Retrieved from http://www.smartcompany.com.au/growth/48367-supermarket-monsters-seven-insights-into-how-coles-and-woolworths-came-to-dominate-australian-groceries/

Keith, S. (2012). Coles, Woolworths and the local. Locale: The Australasian-Pacific Journal of Regional Food Studies, 2, 47-81.

King, M. (2016, Apr. 15). ALDI is stealing market share from Woolworths Limited. The Motley Fool. Retrieved from http://www.fool.com.au/2016/04/15/aldi-is-stealing-market-share-from-woolworths-limited/

Langmore, D. (2007). Australian dictionary of biography: Vol. 17-. Carlton (Victoria: Melbourne Univ. Press.

McCarthy, J. (2013, Jan. 10). Coles Express stores join price war. The Courier-Mail. Retrieved from http://www.couriermail.com.au/news/queensland/coles-express-stores-join-price-war/story-e6freoof-1226550755383

McCracken, M., Currie, D., & Harrison, J. (2015). Understanding graduate recruitment, development and retention for the enhancement of talent management: sharpening ‘the edge’of graduate talent. The International Journal of Human Resource Management, 1-26.

Naranjo-Valencia, J. C., Jiménez-Jiménez, D., & Sanz-Valle, R. (2016). Studying the links between organizational culture, innovation, and performance in Spanish companies. Revista Latinoamericana de Psicología, 48(1), 30-41.

O’Reilly, C. A., Caldwell, D. F., Chatman, J. A., & Doerr, B. (2014). The promise and problems of organizational culture CEO personality, culture, and firm performance. Group & Organization Management, 39(6), 595-625.

Rajasekar, J., & Al Raee, M. (2013). An analysis of the telecommunication industry in the Sultanate of Oman using Michael Porter's competitive strategy model. Competitiveness Review: An International Business Journal, 23(3), 234-259.

Sotgiu, F., & Gielens, K. (2015). Suppliers caught in supermarket price wars: Victims or victors? Insights from a Dutch price war. Journal of Marketing Research, 52(6), 784-800.

Taylor, J. (2015, Jun. 3o). Coles pays $12 million to Australian suppliers after investigation finds buyers 'threatening.' ABC. Retrieved from http://www.abc.net.au/news/2015-06-30/coles-supermarket-pays-$12-million-to-suppliers/6583524

Wei, W., Zhu, W., & Lin, G. (2013). Business Model Positioning and Strategic Positioning. In Approaching Business Models from an Economic Perspective (pp. 47-57). Springer Berlin Heidelberg.

Wesfarmers. (2011). Appendix 4e –preliminary final report & 2011 full-year results. Retrieved from http://media.corporate-ir.net/media_files/IROL/14/144042/Appendix%204E-Preliminary%20Final%20Report,%202011%20Full-Year%20Results.pdf

7.0 Bibliography

Coles. (2016a). Locations and hours. Retrieved from https://www.coles.com.au/store-locatoraz

Coles. (2016b). Our history. Retrieved from https://www.coles.com.au/about-coles/centenary

8.0 Appendix

Porter’s 5 Forces Model

Market Share Gain or Loss by the Key Supermarket Outlets

Mintzberg’s 5Ps Model of Strategy